1 HKScan's approach to remuneration

Remuneration of the Board of Directors and the CEO at HKScan Corporation ("HKScan" or the "Company") is based on the principles of remuneration as set out in the applicable Remuneration Policy and approved by the Board of Directors and the shareholders of HKScan.

The remuneration principles and incentive programs covering senior management have been developed to secure HKScan's competitiveness in its industry. The remuneration programs reflect HKScan Group's business strategy and financial performance, support value-based behaviours and encourage individual and team accountability and reward competitively and fairly.

Our remuneration policy, practices, tools and processes are designed to ensure that we are able to compete and retain the competent workforce, talents and senior management across the complex and long value chain and multiple markets in which we operate. HKScan's remuneration structure consists of base salary, benefits as well as short-term and long-term incentive schemes.

The remuneration principles of other personnel have been described in the effectual HKScan Group HR Policy. The terms of employment and remuneration principles of other personnel respectively aim at increasing the value and the productivity of the Company.

This Remuneration Policy is the first remuneration policy which is presented to the Company's general meeting of shareholders.

2 Remuneration-related decision-making

2.1 General

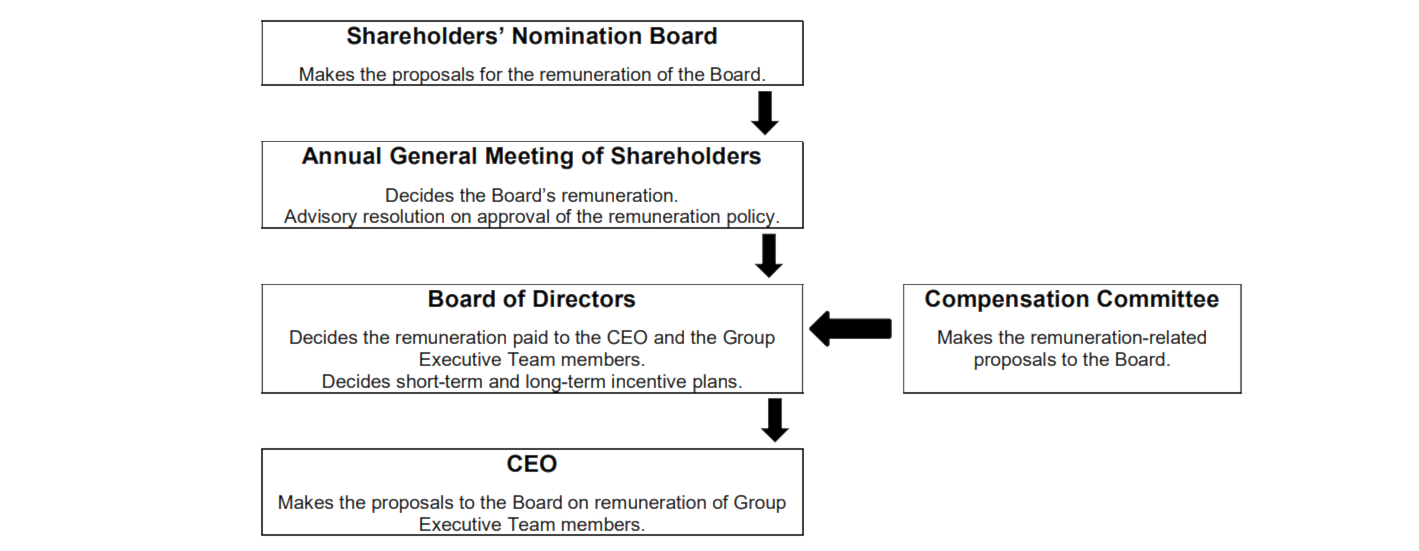

Key stakeholders in remuneration-related discussions and decisions are: the Shareholders’ Nomination Board (or the Board’s Nomination Committee), the Annual General Meeting of Shareholders, the Board of Directors, and the Compensation Committee. The Shareholders’ Nomination Board (or the Board’s Nomination Committee) submits a proposal concerning the remuneration payable to the Board of Directors to the Annual General Meeting, while the Board of Directors is responsible for making decisions on remuneration and incentive arrangements for the CEO based on proposals made by its Compensation Committee. The decision-making process, which is described in the chart below, ensures that decisions are transparent.

2.2 Remuneration Policy

The Board of Directors approves the Remuneration Policy based on the preparation and proposal of the Compensation Committee of HKScan. When preparing and approving the Remuneration Policy, the Board of Directors will diligently assess potential conflict of interest of each member of the Board of Directors and/or the Compensation Committee. The Board of Directors will take the necessary actions to ensure that no individual is involved in the decisionmaking of his/her own remuneration.

The Board of Directors will assess annually whether any amendments to the Remuneration Policy are necessary. The assessment is to be made based on the consultative decisions of the Annual General Meeting as well as views and opinions presented when deciding on the Remuneration Report annually. In addition, the Compensation Committee or the Board of Directors may in its sole discretion resolve to propose amendments to the Remuneration Policy in case such amendments are needed or required to fulfil the requirements of then valid CG Code or remuneration principles of HKScan. The Remuneration Policy will in any case be presented to the Annual General Meeting every four (4) years.

2.3 Decision-making of remuneration of the Board of Directors

The Annual General Meeting of Shareholders decides on the remuneration and other financial benefits of the members of the Board of Directors and its committees annually based on a proposal by the Shareholders’ Nomination Board (or the Board’s Nomination Committee). The remuneration of the Board of Directors always needs to be in line with the currently valid Remuneration Policy.

The Shareholders’ Nomination Board (or the Board’s Nomination Committee) shall ensure that its proposals follow the Company's guidelines on the assessment and administration of conflicts of interest as well as on the acceptance and enforcement of such proposals.

2.4 Decision-making of remuneration of the CEO

The Board decides, based on the proposal made by the Compensation Committee, on the remuneration principles and monitors the realization of the remuneration schemes of the CEO. The remuneration of the CEO shall always be in line with the currently valid Remuneration Policy. The Board of Directors also decides, within the limits of the authorization granted by the General Meeting, on the distribution of shares and terms and conditions thereof, under the share remuneration or share-based remuneration schemes.

The Compensation Committee shall ensure that its proposals follow the Company's guidelines on the assessment and administration of conflicts of interest as well as on the acceptance and enforcement of such proposals.

2.5 Incentives, options and other special rights entitling to shares

The Annual General Meeting of Shareholders decides on the use of the Company's shares for share-based incentives and may authorise the Board of Directors to decide on the issue of shares and special rights entitling to shares.

The Board of Directors decides on the terms and conditions, including e.g. criteria and commencement of the long-term incentive plans and short-term incentive plans of the Company. The Board of Directors may transfer the aforementioned decision-making rights to a Committee of the Board of Directors.

The Board of Directors may under exceptional events or changed circumstances in the Company or its operating environment or in the event of a material change in the Company's business strategy adjust the long-term incentive plans and short-term incentive plans, if the Board of Directors considers that it is well-grounded from the Company's perspective and in the interest of the Company and its shareholders.

3 Remuneration of the CEO

The CEO's remuneration may include a variety of remuneration forms, such as a base monetary salary, insurances, pension, short-term incentive, long-term incentive, share ownership guidelines, sign-on bonus and termination compensation.

The fixed salary may include a monetary salary and various taxable fringe benefits, such as car, housing and telephone. In addition, the CEO may be entitled to other fringe benefits in accordance with the Company's management group practices in force at the time being. The Company may provide the CEO with health services and insurances.

When preparing proposal and evaluating on appropriate total remuneration levels, the Compensation Committee considers pay practices in the HKScan Group as a whole and makes reference to objective external data, which gives current information on remuneration practices in appropriate peer companies of a similar size and complexity to HKScan. The total remuneration for the CEO is compared to that of similar positions in other relevant listed companies.

|

Element |

Purpose and link to strategy |

Maximum earning opportunity and policy implementation |

|

Fixed compensation |

The CEO receives an annual fixed base salary, which the Compensation Committee considers to be market competitive. |

The fixed base salary is reviewed by the Compensation Committee in the beginning of each year and upon a change of position or scope of responsibility. Levels are not subject to the achievement of performance measures. However, an individual’s experience, development and performance in the role will be considered when setting and reviewing salary levels. |

|

Pension |

A retirement benefit in addition to the statutory pension |

In addition to the statutory pension plan, the CEO may be covered by supplementary defined contribution pension plan, which provides a retirement benefit based on the accrued savings capital. |

|

Short-term incentives (STI) |

Short-term incentive opportunity will be linked to the achievement of challenging financial and, when appropriate, nonfinancial performance targets. |

The Board of Directors decides on the plan terms, participants and performance criteria based on strategic targets. The performance measures, weightings and targets are set annually by the Board of Directors. The quantum of short-term incentive is determined on a specified range. Below threshold performance results in a zero incentive. Maximum pay-out is capped at the equivalent of 60% of fixed base salary. The short-term incentive plan is annual-based. |

|

Long-term incentives (LTI) |

Delivery of the group’s long- term performance |

The commencement of the long-term incentive plan requires a shareholder decision after which the Board of Directors shall decide on the terms and conditions of the programme. The long-term incentive plan is based on multiple years. In the long-term incentive plan the remuneration may consist of individual performance share plans and the remuneration is paid in HKScan's shares, if no other remuneration format is announced. The LTI allocation is maximum 150% of annual fixed base salary. The Board of Directors reserves the right to adjust the targets, if events occur (e.g. material acquisition and/or divestment of a Group business), which cause it to determine that they are no longer appropriate. |

|

Shareholding requirement |

|

The Board of Directors recommends that the CEO would hold 50% of all the shares received from long-term incentive plan until the value of share ownership corresponds to individual’s annual salary. This share ownership should be held during the validity of service. The Board of Directors may amend its recommendations at any time. |

The CEO agreement may be terminated by both the CEO and HKScan on a separately agreed notice time. In addition, the CEO may be entitled to receive other compensation in connection with the termination of the CEO agreement, such as, but not limited to, a separately agreed fixed salary or other compensation. In addition, the CEO will be paid the salary for the termination period. The Company may under certain circumstances decline the payment of such compensation in whole or in part or reclaim compensation already paid.

Based on the Board of Directors' decision, the variable remuneration can be paid in parts. The Board can also demand redemption in breach of contract situations.

In addition, the CEO may be entitled to a sign-on bonus or other similar compensation when assuming his duties and any other compensation that is agreed in the CEO agreement.

What is stated above in this Remuneration Policy regarding the CEO's remuneration shall also be applied to the CEO's possible deputy.

4 Board of Directors' remuneration

The Annual General Meeting decides on the remuneration and other financial benefits of the members of the Board of Directors and its Committees annually. The Shareholders’ Nomination Board (or the Board’s Nomination Committee) prepares proposals concerning the election and remuneration of the members of the Board of Directors. The remuneration of the Board of Directors shall always be in line with the Company's current Remuneration Policy.

The fees are set to attract and retain high calibre individuals by offering market competitive fees, taking into account the time that is required to fulfil the relevant role.

The Company has no share-based incentive scheme for the members of the Board of Directors, neither are the members of the Board of Directors covered by the Company's incentive or pension plans. However, the annual fees may be paid in HKScan's shares and cash so that a separately agreed percentage of the remuneration is in the Company's shares acquired on the market on the Board members' behalf, and the rest (such as attendance

payments) may be paid in cash in whole.

5 Deviations from the approved remuneration policy

The Company may deviate from its current Remuneration Policy temporarily under exceptional circumstances, such as a change of the CEO, significant restructurings, changes in the applicable legislation or other situations deemed exceptional by the Board of Directors. The deviation shall according to the assessment of the Board of Directors be in the Company's long-term interests. If the deviation is not deemed temporary, the Company shall prepare a new Remuneration Policy.