ESG at HKScan

> Please take a look at our ESG questionnaire.

> HKScan is a responsible investment.

> Read more about our Corporate responsibility.

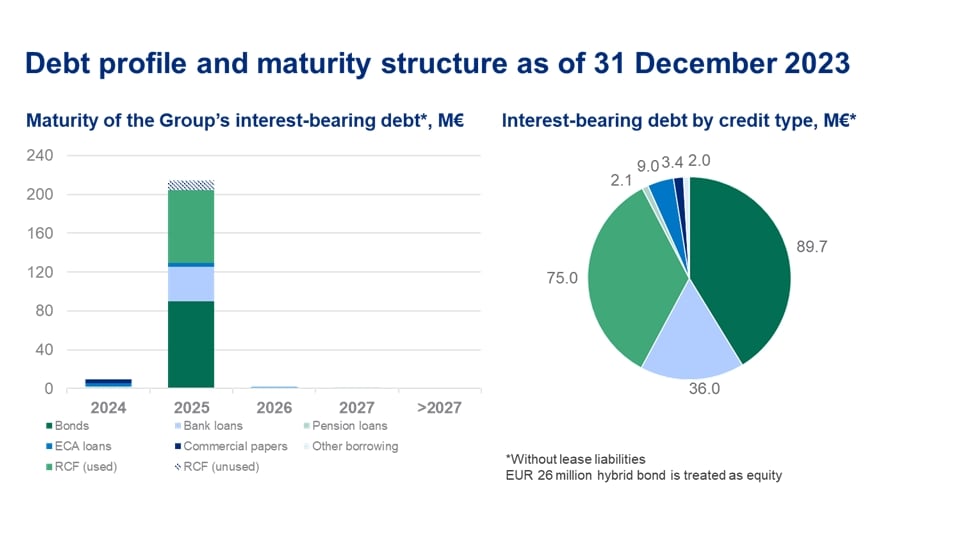

Bond 2025, issued amount EUR 90.0 million

In March 2021, HKScan Corporation issued a senior unsecured bond of a EUR 90 million. The four-year bond matures on 24 March 2025, it carries a fixed annual interest at the rate of 5.000 per cent and has an issue price of 100 per cent.

The proceeds from the bond offering were partially used for the partial repurchase of HKScan Corporation’s existing EUR 135 million 2.625 per cent fixed-rate unsecured senior notes. The remainder of the proceeds received will be used for general corporate purposes.

Nordea Bank Abp and OP Corporate Bank plc act as coordinators for the issue of the bond and together with Danske Bank A/S and DNB Bank ASA, Sweden Branch as joint lead managers for the issue of the bond.

> Read more and access the Listing prospectus of the New Notes

Hybrid bond, outstanding EUR 25,9 million

In September 2018, HKScan Corporation issued a EUR 40 million hybrid bond. After the conversions carried out in the context of the share issue in June 2019, the outstanding amount is EUR 25.9 million. The coupon of the hybrid bond is 8.00 per cent per annum, but it will be subject to a coupon reset on each fifth anniversary of the issue date of the hybrid bond.

The hybrid bond does not have a specified maturity date but HKScan is entitled to redeem the hybrid bond for the first time on the fifth anniversary of the issue date, and subsequently, on each annual coupon interest payment date.

The hybrid bond issuance will strengthen HKScan's capital structure and financial position. The net proceeds of the issuance will be used for general corporate purposes.

Read more: Key Information Document